Framed - movie guessing game - Red_Dragon - May 12, 2025 - 9:42am

Wordle - daily game - marko86 - May 12, 2025 - 9:41am

Trump - Red_Dragon - May 12, 2025 - 9:29am

NY Times Strands - ptooey - May 12, 2025 - 8:48am

Today in History - islander - May 12, 2025 - 8:47am

Celebrity Face Recognition - islander - May 12, 2025 - 8:07am

Radio Paradise Comments - islander - May 12, 2025 - 8:02am

NYTimes Connections - ptooey - May 12, 2025 - 7:42am

No TuneIn Stream Lately - rgio - May 12, 2025 - 5:46am

Global Warming - rgio - May 12, 2025 - 4:39am

New Music - miamizsun - May 12, 2025 - 3:47am

Talk Behind Their Backs Forum - winter - May 11, 2025 - 8:41pm

Name My Band - GeneP59 - May 11, 2025 - 6:47pm

The Dragons' Roost - triskele - May 11, 2025 - 5:58pm

Photography Forum - Your Own Photos - Manbird - May 11, 2025 - 5:26pm

Bug Reports & Feature Requests - epsteel - May 11, 2025 - 12:30pm

Ukraine - R_P - May 11, 2025 - 11:03am

Things You Thought Today - GeneP59 - May 11, 2025 - 9:52am

Breaking News - Steely_D - May 10, 2025 - 8:52pm

May 2025 Photo Theme - Action - fractalv - May 10, 2025 - 7:54pm

Republican Party - Red_Dragon - May 10, 2025 - 3:50pm

Strips, cartoons, illustrations - R_P - May 10, 2025 - 2:16pm

Israel - R_P - May 10, 2025 - 1:18pm

Real Time with Bill Maher - R_P - May 10, 2025 - 12:21pm

Artificial Intelligence - q4Fry - May 10, 2025 - 10:01am

No Rock Mix on Alexa? - epsteel - May 10, 2025 - 9:45am

Kodi Addon - DaveInSaoMiguel - May 10, 2025 - 9:19am

What Makes You Laugh? - Isabeau - May 10, 2025 - 5:53am

Upcoming concerts or shows you can't wait to see - KurtfromLaQuinta - May 9, 2025 - 9:34pm

Immigration - R_P - May 9, 2025 - 5:35pm

Basketball - GeneP59 - May 9, 2025 - 4:58pm

The Obituary Page - GeneP59 - May 9, 2025 - 4:45pm

Pink Floyd - miamizsun - May 9, 2025 - 3:52pm

Freedom of speech? - R_P - May 9, 2025 - 2:19pm

Questions. - kurtster - May 8, 2025 - 11:56pm

How's the weather? - GeneP59 - May 8, 2025 - 9:08pm

Pernicious Pious Proclivities Particularized Prodigiously - R_P - May 8, 2025 - 7:27pm

Save NPR and PBS - SIGN THE PETITION - R_P - May 8, 2025 - 3:32pm

How about a stream of just the metadata? - ednazarko - May 8, 2025 - 11:22am

Baseball, anyone? - Red_Dragon - May 8, 2025 - 9:23am

no-money fun - islander - May 8, 2025 - 7:55am

UFO's / Aliens blah blah blah: BOO ! - dischuckin - May 8, 2025 - 7:03am

Positive Thoughts and Prayer Requests - miamizsun - May 8, 2025 - 5:53am

Into The Wild - Red_Dragon - May 7, 2025 - 7:34pm

Get the Money out of Politics! - R_P - May 7, 2025 - 5:06pm

What Makes You Sad? - Antigone - May 7, 2025 - 2:58pm

USA! USA! USA! - R_P - May 7, 2025 - 2:33pm

The Perfect Government - Proclivities - May 7, 2025 - 2:05pm

Musky Mythology - R_P - May 7, 2025 - 10:13am

Living in America - islander - May 7, 2025 - 9:38am

DQ (as in 'Daily Quote') - JimTreadwell - May 7, 2025 - 8:08am

Pakistan - Red_Dragon - May 6, 2025 - 2:21pm

SCOTUS - R_P - May 6, 2025 - 1:53pm

Canada - R_P - May 6, 2025 - 11:00am

Solar / Wind / Geothermal / Efficiency Energy - ColdMiser - May 6, 2025 - 10:00am

Lyrics that strike a chord today... - ColdMiser - May 6, 2025 - 8:06am

What's your mood today? - GeneP59 - May 6, 2025 - 6:57am

China - R_P - May 5, 2025 - 6:01pm

Trump Lies™ - R_P - May 5, 2025 - 5:50pm

Song of the Day - rgio - May 5, 2025 - 5:33am

Love the Cinco de Mayo celebration! - miamizsun - May 5, 2025 - 3:53am

how do you feel right now? - miamizsun - May 5, 2025 - 3:49am

Mixtape Culture Club - miamizsun - May 5, 2025 - 3:48am

The Bucket List - Red_Dragon - May 4, 2025 - 1:08pm

260,000 Posts in one thread? - winter - May 4, 2025 - 9:28am

Australia - R_P - May 3, 2025 - 11:37pm

M.A.G.A. - R_P - May 3, 2025 - 6:52pm

Democratic Party - Isabeau - May 3, 2025 - 5:04pm

Philly - Proclivities - May 3, 2025 - 6:26am

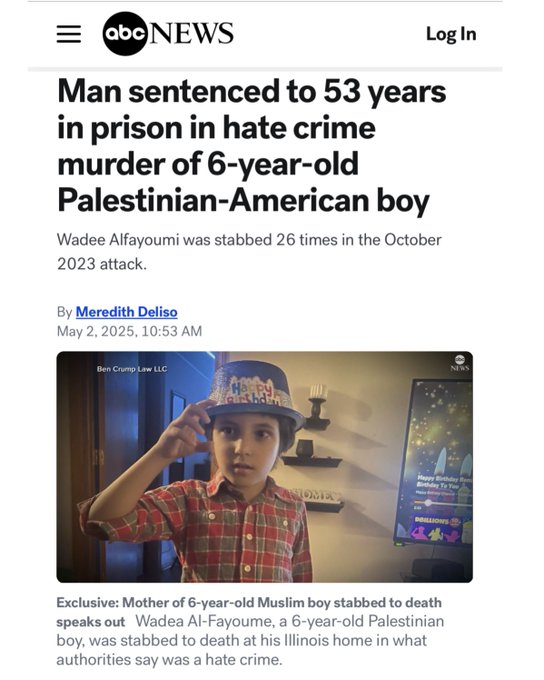

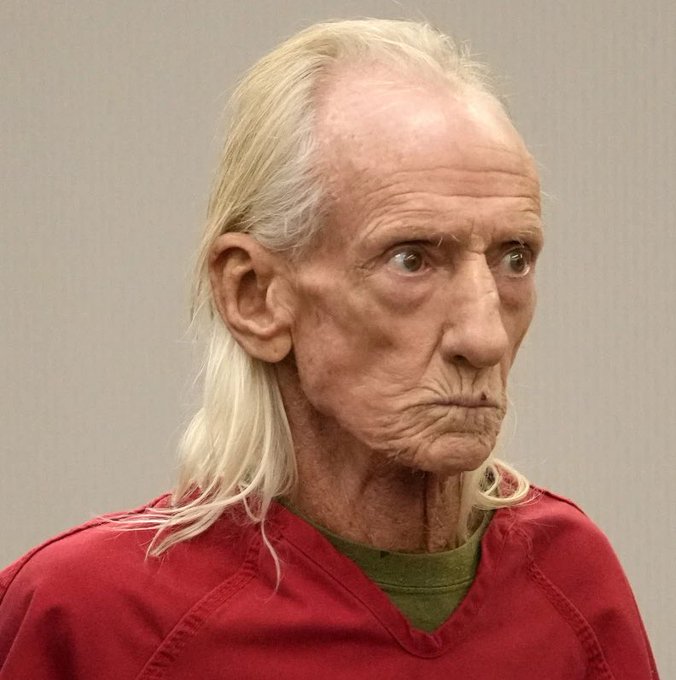

Race in America - R_P - May 2, 2025 - 12:01pm

Multi-Room AirPlay using iOS app on Mac M - downbeat - May 2, 2025 - 8:11am

YouTube: Music-Videos - black321 - May 1, 2025 - 6:44pm

Museum of Iconic Album Covers - Proclivities - May 1, 2025 - 12:24pm

Regarding cats - Isabeau - May 1, 2025 - 12:11pm

When I need a Laugh I ... - Isabeau - May 1, 2025 - 10:37am

Index »

Regional/Local »

USA/Canada »

Race in America

Page: 1 , 2 , 3 ... 73 , 74 , 75 Next

R_P

Posted:

Feb 16, 2026 - 2:02pm

black321

Posted:

Feb 12, 2026 - 2:06pm

R_P wrote:

That's what

books are for.

never read it, but seems like the wrong book

R_P

Posted:

Feb 12, 2026 - 2:01pm

black321 wrote: hmm, look deeper.

That's what

books are for.

black321

Posted:

Feb 12, 2026 - 1:58pm

R_P wrote:

hmm, look deeper.

R_P

Posted:

Feb 12, 2026 - 12:34pm

R_P

Posted:

Feb 6, 2026 - 10:08am

R_P

Posted:

Feb 3, 2026 - 9:12am

Red_Dragon

Posted:

Jul 31, 2025 - 12:23pm

R_P

Posted:

May 2, 2025 - 12:01pm

R_P

Posted:

Feb 28, 2025 - 1:52pm

Stochastic terrorist

R_P

Posted:

Feb 3, 2025 - 5:34pm

From "Merit" to Eugenics: Elon Musk's Plan for America (w/ Anita Say Chan)

VIDEO

Sometimes there's an interview that brings radical clarity about the current moment. Professor Anita Say Chan's book Predatory Data: Eugenics in Big Tech & Our Fight for an Independent Future ties Elon Musk, Peter Thiel, and the tech billionaires empowered under Trump to eugenics movement of the 19th and 20th centuries with chilling specificity. She offers two key insights: First, that the focus on "merit" is an effort to convince Americans to give up democracy (in which everyone gets a vote/say/rights on the basis of their humanity) in favor of a system where various qualifications (IQ/race) "qualify" you for rights. Second, she argues that by claiming only they (and their individual genius) can save the world, tech giants are persuading Americans that government should shrink to a "benevolent autocracy" where the rich rule. As Peter Theil has said, "I no longer believe that freedom and Democracy are compatible." Seen through the lens of the eugenics movement, the end goals become shockingly clear, as does the role the left must play.

R_P

Posted:

Oct 6, 2024 - 9:42pm

sirdroseph

Posted:

Sep 20, 2024 - 4:00am

VIDEO

R_P

Posted:

Jul 23, 2024 - 12:15pm

VIDEO

Red_Dragon

Posted:

Jul 16, 2024 - 3:53pm

Red_Dragon

Posted:

Aug 26, 2023 - 4:18pm

Red_Dragon

Posted:

Jun 22, 2023 - 9:08am

VIDEO

R_P

Posted:

Mar 5, 2023 - 9:59am

R_P

R_P

Posted:

Feb 1, 2023 - 8:42pm

kcar wrote:

Is there some sort of magic required to view the posts with tweets in them? 'Cause all I see is a Twitframe with the tweeter's address, the words "Loading tweet..." below that and the hyperlinked words "Unknown date" below that. The link takes me nowhere.

A setting in your browser/anti-virus/firewall might be blocking that iframe, but it's the same principle as a youtube video embed.

The tweets are provided through

https://twitframe.com .

You should be seeing:

Warning : pg_close(): supplied resource is not a valid PostgreSQL link resource in /var/www/html/rp3.php on line 474